Still working to recover. Please don't edit quite yet.

monetary fraud

The main monetary fraud is associated with the money created by central banks and state banks. The new money created by central banks is sent to few beneficiaries, instead of being distributed equally to all people.

Wealth is thus artificially redistributed from the (non-black) market users, users of a continuously devalued money, to banks and their direct beneficiaries (institutions, shareholders).

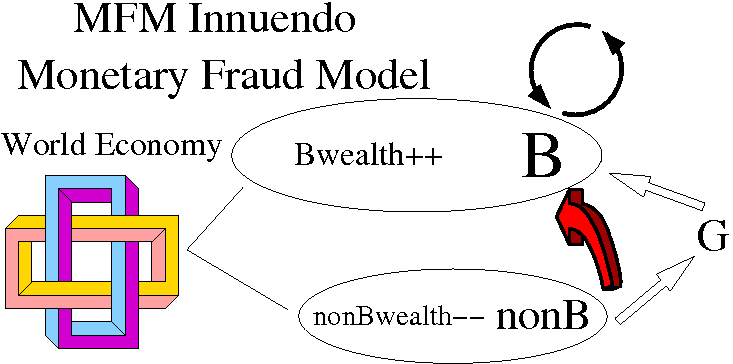

MFM: Monetary Fraud Model[edit]

Almost all money has been created by private banks, worldwide. Only a small fraction (because of the low Reserve Ratio Requirements) of money is created by central banks (private in the USA Federal Reserve, state-owned in UK and most other countries ). Money is created as debt in a way that cannot be paid off. Without debt toward private banks (that create most of the money in circulation), the money supply would drain up. All money would disappear from the system. This forces people to get new loans, escalating the unescapable debt-spiral.

The method for money creation is the money multiplication process that you can read about in wikipedia or other sources. It is just the case that most sources do NOT explain how this system transfers ALL WEALTH OF THE WORLD to the private beneficiaries of money creation.

If this sounds too farfetched (as it likely does, to most people), try to show how this can be prevented without important changes (that are certainly not impossible, but not going to happen without our intervention): see Monetary Fraud Model Award. That way you can either reject the MFM model (substitute with a better model) or you can understand the problem and get a better picture of the direction society should progress into.

People (falsely) believe they are able to keep their wealth by producing more. In reality they are losing all their wealth (and influence), until they realise this monetary problem cannot be cured by fiscal methods.

To understand, how wealth is transferred, we need to consider that

- a part of world wealth is already owned by the beneficiaries of private money creation ("banks"): Bwealth

- the remaining wealth is owned by the rest: NonBwealth

There is no distinguished line around wealth: for example a shareholding company can be partially Bwealth and partially NonBwealth. This is no problem. So ... what happens ?

- wealth suffers some amortization

- wealth is used to produce new wealth

Nothing special so far: the ratio of Bwealth and NonBwealth is unchanged. However, the money all over the world, that is used in transactions are created by B group. Companies and individuals pay interest (a kind of a tax for loaning the money into existance).

- While interest payment related to production involving Bwealth is just from one pocket to the other of the same owner)

- interest payment (to B !) related to production involving NonBwealth reduces NonBwealth and contributes to Bwealth

This inevitably transfers all wealth to Bwealth. Try to make a model that prevents this !

A spreadsheet that shows the effect of nonBwealth being transferred to Bwealth as years pass by: http://mfm5.250free.com/MFM_trap.xls (click download)

- how much money should be in the system ?

- interest rates ?

- how much to produce ? GDP, NDP ?

- what percentage of GDP should be spent on debt pay-off ?

You can start from it (and tweak values) or make your own model, you can use ANY numbers you think appropriate.

You can tune this or create your own model, more complex if you like (eg. add multiple currencies and import-export). Just a guess, Bwealth was probably around 20% of world wealth on 1913 December 23d (when most congressmen left for xmas and the corrupt minority voted yes on the Federal Reserve Act crime). Bwealth is probably 80% now, although the example assumes it is 60% at this time. You can change it to start from 0%, it does not matter: the final result is the same !

You can make the model more complex if you like.

- The laws, most notably related to taxes and government spendings are biased to aid this wealth transfer (Bwealth actually benefits more from government spendings, and taxes less, eg. using offshore).

- The efforts (biasing laws) behind NonBwealth are not near as efficient as those behind Bwealth: the proof is the existance of this fraudulent monetary (and tax) system

The interest is payed:

- in taxes (essentially growing, due to national debt)

- and market-prices (corporations build their costs into prices: this includes interests)

- so even if someone is not willing to loan money, he is unable to protect his wealth: it will become Bwealth

At a macro level, producing more does not help pushing down the debt AT ALL. As an example, let's say more chairs are produced.

- if the extra quantity of chairs cannot be sold, it's just a waste of resources

- if the excess chairs can be sold, those who buy it will have somewhat less money, those who sold the chair have somewhat more money.

The total amount of money to pay off debt is unchanged: the debt continuously grows, people losing all their wealth and control, as long as people insist on this fraud money (USD, GBP, EUR, ...).

Wealth is actually distributed unevenly. By producing more we might be able to keep our wealth a bit further (by helping others get ripped of their wealth earlier): we are likely to find ourselves in a very nasty situation:

- most people, desperate, working hard, have lost all their wealth and also in huge debt they finally realize can never be paid off

- we - being smarter - still have some wealth

All the desperate people will not be able to find the high-criminals behind Bwealth (enough wealth to efficiently protect, access to personal identities, etc..). They will be able to find us though, and they will be very angry. They will not think straight, because we haven't taught them how to think straight. Don't wait until it is too late.

NonBwealth is actually transferred faster than the MFM model predicts:

- the interest paid related to NonBwealth is relatively higher than for Bwealth

- because NonBwealth is more fragmented, including small-medium enterprises and household wealth. Essentially much higher liquidity ratio than the more concentrated Bwealth (large monopolies and high cash-flow => low relative liquidity).

Unfortunately you cannot join the B group by purchasing banking shares. Banks route their profit through (often international) investments that small shareholders don't benefit much from. This is quite obvious, natural behaviour, to reduce taxes.

What is the solution?[edit]

- if people start to use their brain and wake up: private creation of money must cease! Reserve Ratio Requirements must be fixed

- "starting thinking" is by no means easy. It has technological side, like censorship resistant sharing like [[1]] and reputation systems. It has its mental side: be very critical about information that penetrates our brain: judge according to its relation with reality (natural and legal system laws, observations), not according to how widespread it is

- tax laws must change:

- instead of taxing the poor (with income tax and stupid corporate taxes) transferring wealth from poor to the wealthy,

- company shares must be debased by the government, distributing a small part of the wealth every year among the people. This is necessary, because even without private money creation, there is a (much slower) concentration of wealth that must be balanced

- crypto-anarchy will be a huge help to those who understand the problem first: even if most of the population stays brainwashed. This unavoidably happens during the evolution towards the next system

- a complete absence of the state could also benefit the extremely rich and powerful. There is a window in the middle for a reasonable government with lightweight budget, but important tasks. It is law that got perverse by today (while we were not watching carefully). Not the idea of a government that enforces the law.

See

- Money Quiz for how money is created

- Monetary reform movement is catching up: http://www.moneyreformparty.org.uk/

- New monetary system is born. Technology helps: http://www.p2pfoundation.net/Category:Money

- monetary system